taxes on fanduel winnings|FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings : Pilipinas Fanduel winnings can come with tax implications, so it’s always beneficial to plan accordingly. Use the information provided here, along with professional . Check out the official Mystic River (2003) Trailer starring Sean Penn! Let us know what you think in the comments below. Buy or Rent on FandangoNOW: https:/.

taxes on fanduel winnings,Learn how to report your FanDuel winnings on your taxes, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how to . Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a .

Fanduel winnings can come with tax implications, so it’s always beneficial to plan accordingly. Use the information provided here, along with professional .

For instance, your winnings might be below these thresholds, but be mindful that you're supposed to pay taxes on anything you win.FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings Gambling winnings usually are subject to state taxes only in the jurisdictions where the winnings were earned. That’s important to understand since state . Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report .Sam McQuillan. Updated: Apr 05, 2022, 09:05 AM EDT. Download App. With two weeks left before the deadline to file your federal income taxes for 2022, Action Network's Sam McQuillan sat down with Richard . The payer of your winnings will deduct 24% of the total for taxes and will give you a copy of IRS Form W-2G to record the transaction if you win a substantial amount .You can also customize and view certain months throughout the years or by app and product. This statement is not a tax document. You can read much more about taxes and FanDuel by clicking here. There's even .

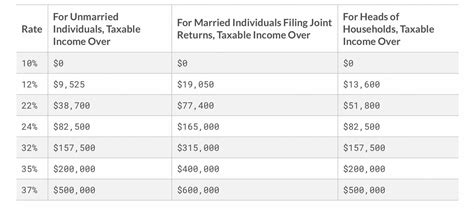

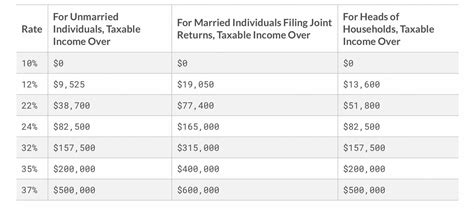

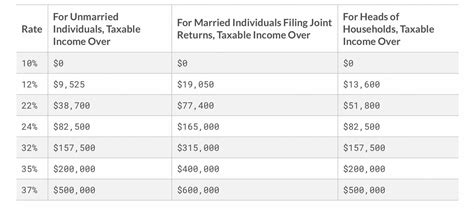

There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for .Winnings From Online Sports Sites Are Taxable. If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should also send both you .

How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel .

In 2022, legal sports wagers on sites like FanDuel and DraftKings totaled $93.2 billion. Wall Street Journal tax reporter Laura Saunders joins host J.R. Whal.Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I..

While FanDuel winnings are generally considered taxable income, not all winnings may be subject to reporting depending on the amount won and the frequency of your gambling activities. Amount won: As mentioned earlier, the IRS has set a reporting threshold of $600 for gambling winnings. If your total winnings from FanDuel in a tax year exceed . Taxes on gambling winnings: You might get a Form W-2G. Generally, you'll receive an IRS Form W-2G if your gambling winnings are at least $600 and the payout is at least 300 times the amount of .

© Betfair Interactive US LLC, 2024 If you or someone you know has a gambling problem or wants help, please check out our Responsible Gaming resources. Major fantasy sports sites and apps (DraftKings, FanDuel, BetMGM, etc.) have an obligation to send winners IRS Form 1099-MISC which contains all the information they need to report fantasy sports winnings for taxes. This same information is sent to the IRS, so the IRS knows if you misreport or fail to report your winnings.You will see these options available in the upper right-hand corner of the individual W2-Gs & Year End Reports page (s). Please note: W2-G forms / Year End Reports for 2023 will be available following January 31st, 2024. Click on the Account icon in the upper right-hand corner of the TVG website to access the W2-Gs & Year-End Reports.

taxes on fanduel winningsEmbrace the suck. If you don't report it and the IRS has to fix your return for you, you'll absolutely be taxed on all 10,000 and your 9900 in losses won't be deducted. If you do report it (hopefully fanduel DTRT and sends you a W-2G at the end of the year, but not having the form doesn't excuse you from having to report it), you'll be able to .Taxes - Frequently Asked Questions - W-2G, 1099, winnings and more. This FAQ covers frequent tax questions that we receive about our Online Sportsbook, Daily Fantasy, Racing, Faceoff, and Online Casino products, and the IRS-required “Tax Forms” associated with your play on our products. This FAQ is intended to provide general answers to .

Taxes Payable for FanDuel Sportsbook. In general, taxes on FanDuel Sportsbook winnings depend on the amount you have won and your overall taxable income. Any sports betting winnings over $600 (or if the amount is 300 times the original bet) are subject to a 24% withholding rate tax, which can be deducted from your winnings at the .Capital-Lobster. ADMIN MOD. Tax help- fanduel withheld 11,000$ in winnings. Hey guys- fanduel is refusing to help me out with this. Was hoping to see if anyone has any experience regarding this. I won a monster same game . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or .taxes on fanduel winnings FanDuel Taxes 2023: How to Pay Taxes on Betting WinningsWe would like to show you a description here but the site won’t allow us.Yes. In Ohio, the tax rate for the operators is 10% of the gross revenue. For the bettors, gambling winnings are taxable income like any other. You're required to keep track of and report any winnings on your tax return, and if you win at least 300 times what you bet, and that amount is over $600, the gambling house will have to report it too.

taxes on fanduel winnings|FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH0 · Where can I see my Win/Loss or Player Activity

PH1 · What Taxes Are Due on Gambling Winnings?

PH2 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH3 · Taxes on Sports Betting: How They Work, What’s

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · How to Pay Taxes on Sports Betting Winnings

PH6 · How Much Taxes Do You Pay On Sports Betting?

PH7 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH8 · Effective Strategies to Handle Tax Withholding on FanDuel